128 companies got funded, some multiple times. $1.95 billion, 50% more than 2015 which was also a phenomenal year with over $1.32 billion funded.

2016 Best Year Ever for Funding Robotics Startup Companies

Frank Tobe | The Robot Report

Reprinted with permission from The Robot Report:

It was a busy and abundant year for seed, crowd, series A,B,C,D and VC funding of robotics-related startups. 128 companies got funded, some multiple times. $1.95 billion, 50% more than 2015 which was also a phenomenal year with over $1.32 billion funded.

Velodyne LiDAR got the most money in 2016, $150 million, with Zymergen and UBTech also getting over $100 million each.

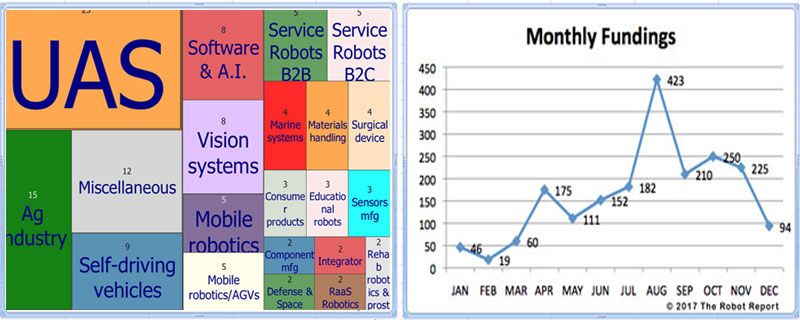

In monthly recaps by The Robot Report, fundings grew until they peaked in August and then dipped in December. August was the month when Velodyne got their $150 million and Quanergy got $90 million. The next highest in August was $35 million for FormLabs.

The colorful chart on the left recaps the number of companies receiving funding by application area. 25 unmanned aerial systems companies got the biggest number of fundings followed by 15 agricultural robotics startups, service robotics for businesses, service robots for personal use, vision systems providers, self-driving systems and mobile robotics and AGVs companies, plus a whole bunch of smaller categories. Investments in robotic solutions for the ag industry were noted by Rob Leclerc of AgFunder who said:

“The number of deals grew 7% year-over-year, as we recorded 307 deals this half compared to 286 during the first half of 2015. The number of investors coming into the sector climbed 52% from 280 in the first half of 2015 compared with 425 in the first half of 2016, which suggests that investors are getting more comfortable with the sector.”

The list of 128 companies funded in 2016

| Velodyne LiDAR | 150.0 | A Morgan Hill, Calif.-based provider of technology that lets self-driving cars see and avoid what's around them, raised $150 million in equity funding from Ford Motor Co. and Baidu. Velodyne expects an exponential increase in LiDAR sensor deployments in autonomous vehicles and ADAS applications over the next several years, driving high revenue growth. Read more. |

| Zymergen | 100.0 | A Silicon Valley integrator of lab robotics in industrial biotech, raised $130 million in a Series A funding led by Softbank and Data Collective and including AME Cloud Ventures, Draper Fisher Jurveston, HVF, Innovation Endeavors, Obvious Ventures, True Ventures and Two Sigma Ventures. Zymergen is attempting to produce industrial chemicals used in making products such as soap, ink and paint - a $3 trillion market. Zymergen hopes to capture this market by creating the building blocks of these products from non-petroleum sources and creating microbes automated in what they call 'Robotics for high-throughput biology.' |

| UBTech | 90.0 | (Union Brother Technology), a Shenzhen startup developing small consumer humanoid robots, got $100 million in a Series B funding round led by CDH Investments with CITIC Securities. UBTech's new $1,300 Alpha2 robot is getting lots of media attention and was available for sale in time for Christmas. |

| Quanergy Systems | 90.0 | A Sunnyvale, Calif.-based provider of solid state LiDAR sensors and smart sensing solutions, raised $90 million at a valuation of over $1 billion. Backers include Sensata Technologies, Delphi Automotive, Samsung Ventures, Motus Ventures and GP Capital. Read more. |

| Carbon 3D | 81.0 | A Silicon Valley 3D printer startup, raised $81 million from a group of 6 investors led by BMW Group and Sequoia Capital, GE, Nikon, JSR and GV. Parts made on Carbon machines, using the company’s resins and elastomers, have different mechanical properties and a smoother surface than parts produced on traditional CNC machines because they’re not deposited layer by layer, cut or milled. Instead, they’re sculpted by precisely applying light and oxygen to a liquid pool of material. BMW and Ford are early users of this technology. |

| Seven Dreamers Labs | 60.0 | This Japanese startup which raised around $60 million in a Series B round that included Panasonic, SBI Investment and Daiwa House, has a new laundry folding robot (Laundroid) that was a hit at CES and CEATEC Japan. |

| Anki | 52.5 | A maker of robotic race-cars, the new Cosmo robot and other consumer robots, has raised $52.5 million in new VC funding. J.P. Morgan led the round, and was joined by Andreessen Horowitz, Index Ventures and Two Sigma. |

| Rokid | 50.0 | A Silicon Valley and Chinese AI and robotics company with a novel Jibo-like social assistant, has raised around $50 million in Series B funding. Advantech led the round, and was joined by existing investors IDG Capital Partners and Walden International. |

| Zoox | 50.0 | A secretive Silicon Valley startup working to build its own self-driving cars, has quietly raised $50 million in a Series A round led by Composite Capital Management, a Hong Kong-based hedge fund. |

| Zipline Intl | 43.8 | A San Francisco-based meds drone delivery service startup, raised another $25 million (in Nov) in its B round from Visionaire Ventures and Andreessen Horowitz, Jerry Wang, Sequoia Capital and Subtraction Capital. It raised $800k from UPS and $18 million from Yahoo founder Jerry Yang, Microsoft co-founder Paul Allen and others to develop their small robot airplane designed to carry vaccines, medicine and blood to remote areas where health workers place text orders for what they need. |

| FormLabs | 35.0 | A designer and manufacturer of 3D printing systems based in Somerville, Mass., has raised $35 million in Series B funding from Foundry Group and Autodesk. |

| Navya Technology | 33.0 | A French developer of driverless electric and robotic vehicles, has raised $33 million in new VC funding. Keolis, Valeo and Group8 (Qatar) were joined by return backers Rebolution Capital (now part of 360 Capital Partners, CapDecisif Management and Gravitation. |

| Desktop Metal | 33.5 | A Lexington, MA-based industrial 3D metals printing startup, has raised $33.76 million in second-round funding, according to an SEC filing. Backers include NEA, Kleiner Perkins and Lux Capital. |

| Mazor Surgical | 31.9 | An Israeli company, has sold $11.9 million of their stock, 4% of their shares, to Medtronic, a global medical technology, services, and solutions provider, with a performance agreement to sell another 6% for up to $20 million. An additional clause of the agreement kicks in if performance milestones are met whereby Mazor can issue an addition 5% of new shares for an additional $20M from Medtronic. Details of the deal are here. |

| Airware | 30.0 | The San Francisco UAS autopilot maker, got $30 million in a round that included former Cisco CEO John Chambers as an investor. Chambers will join the Airware board of directors. |

| Clearpath Robotics | 30.0 | A Canadian mobility company, raised $30M in a Series B funding round led by iNovia Capital with participation from Caterpillar Ventures, GE Ventures, Eclipse Ventures, RRE Ventures and Silicon Valley Bank. The bulk of the capital will be used to scale up manufacturing, hire employees and expand go-to-market strategies for the self-driving vehicles made with Clearpath’s OTTO division for materials handling and transport in factory and warehouse environments. |

| AI Robotics | 28.5 | An Israeli UAS startup (not to be confused with AI-Robotics, a Beijing startup), received an additional $6 million in a combined Series A and B round concluded in June where they got $22.5 million. Backers included BlueRun Ventures, CRV, UpWest Lab as well as private individuals such as Noam Bardin, the CEO of Waze, and Richard Wooldridge, Google ATAP’s COO. AI Robotics provides an on-site and on-demand automated drone platform that allows companies to run missions to monitor, inspect, survey and secure large industrial facilities and other strategic sites via aerial data collection, processing and analysis. The company currently has a team of 70 people. |

| 3D Robotics | 26.7 | Filed an SEC Notice for a $45 million offering of which $26.7 million had been raised as of the date of filing. Autodesk was an investor and said that 3DR is using their Autodesk Forge Platform “to develop one of the industry’s most trusted aerial data capture and analytics platforms for enterprise field professionals within infrastructure, construction, survey, mapping, telecom, and energy industries.” |

| Skydio | 25.0 | A Silicon Valley drone vision and navigation systems provider, got $25 million from Andreessen Horowitz and Accel, a Palo Alto VC. |

| Shenzhen Flypro Aerospace | 23.0 | A Chinese startup, got around $23 million in a B round from Shenzhen Capital Group. FLYPRO produces two types of quadcopters: a racing drone and a camera drone. |

| Zero Zero Robotics | 23.0 | A Beijing-based startup, raised $23 million in a Series A round. Backers included IDG, GSR Ventures, ZhenFund, Zuig and others. Zero Zero offers a Hover Camera, a portable autonomous flying indoor or outdoor camera system, a neat fold-over book-like device. |

| AIRobotics | 22.5 | An Israeli UAV startup focusing on providing an all-purpose drone solution for industrial applications, raised $22.5 million. Funders, led by CRV, included BlueRun Ventures, Noam Bardin, Richard Wooldridge and UpWest Labs. The company has 70 employees. |

| Mavrx | 22.4 | A San Francisco-based developer of aerial imagery technologies focused on the ag industry and big data, secured $12.42 million of a Series A round, and an additional $10M for the same Series A round led by Eclipse with Bloomberg Beta and Visionnair Ventures, according to a regulatory filing. |

| Glowforge | 22.0 | A Seattle-based 3D laser printer company, raised $22 million in Series B funding. The round was led by Foundry Group and True Ventures. Last year Glowforge set a crowdfunding record by raising $27.9 million in just 30 days. Glowforge printers can be used to cut and engrave on pretty much any surface. |

| Cambridge Medical Robotics | 20.0 | A UK developer of a robotic system for keyhole surgery, has raised $20 million in Series A funding. Backers include LGT Global Invest, ABB Technology Ventures and Cambridge Innovation Capital. |

| DronDeploy | 20.0 | A San Francisco-based startup raised $20 million to (1) grow their drone data management platform and (2) for hiring, product development, sales and marketing. Scale Venture Partners led the investment and was joined by High Alpha Fund. The DroneDeploy platform allows users to plan flights, pilot drones either one at a time or in fleet formations, and gather and analyze myriad data types to create detailed maps and 3-D models. |

| Eyesight Technology | 20.0 | An Israeli vision systems startup, raised $20 million from a Chinese VC group, for its vision system of sensing, gesture recognition and user awareness to be embedded into consumer products. |

| Farmers Business Network | 20.0 | An Iowa-based developer of an ag industry software and analytics system, raised $20 million to help farmers avoid spending on what they don’t need as they provide data to help compete with Monsanto and Dupont. |

| uSens | 20.0 | A San Jose, CA-based developer of natural hand-and-head tracking technologies for augmented and virtual reality, raised $20 million in Series A funding led by Fosun Kinzon Capital. |

| Wonder Workshop | 20.0 | A Sunnyvale, CA-based maker of robots that teach kids computer science and coding fundamentals, raised $20 million in Series B funding. WI Harper Group and Idea Bulb Ventures co-led the round, and were joined by Learn Capital, Charles River Ventures, Madrona Venture Group and TCL. |

| nuTonomyy | 19.6 | A Cambridge-based start-up that raised $16 million in a Series A round of funding from a group of Singapore and US VCs. This is in addition to $3.6 million raised earlier in 2016 which included funds from Ford Chairman Bill Ford. nuTonomy is planning to launch a fleet of autonomous taxies in Singapore by 2019 and began testing in both Singapore and Pittsburgh. |

| Precision Hawk | 19.0 | Raised $19+ million in a Series C round of venture funding to focus their effort toward a wide range of commercial purposes. PrecisionHawk is the maker of the Lancaster fixed-wing drones for farmers. New investors include: Verizon Ventures, USAA, NTT Docomo Ventures, Yamaha Motor Ventures, and Dupont Pioneer, the ag division of Dupont. |

| Farmers Edge | 18.3 | A Canadian precision ag data consolidator/integrator startup, has raised another $18.3 million - the 3rd raise in 2016 although the first two amounts were undisclosed. This time the round was led by Sustainable Dev Tech Canada (SDTC) with $6.1 and the remaining $12.2 coming from unidentified sources and existing partners. These new funds are earmarked to help the company reduce fertilizer, water and pesticide in their next generation of h/w, s/w and agronomic decision support systems. |

| Drone Racing League | 17.6 | A NY startup establishing a drone racing community and sporting events, raised $12 million in VC funding co-led by Lux Capital and RSE Ventures. Other backers include MGM, Sky Prosieben, Hearst Ventures, CAA Ventures, Vayner/RSE, Courtside Ventures, Sierra Maya Ventures and individual angels. Earlier in the year they got $5.6 million from RSE Ventures. |

| Oryx Vision | 17.0 | An Israel-based developer of solid state depth sensing solutions for autonomous vehicles, has raised $17 million in Series A funding. Bessemer Venture Partners led the round, and was joined by Maniv Mobility and Trucks VC. |

| Kespry | 16.0 | A Menlo Park developer of automated drone systems for commercial use, raised $16 million in Series B funding. DCM Ventures led the round, and was joined by a group of VCs and individuals. |

| Netradyne | 16.0 | A San Diego AI developer of self-driving car systtems, got $16 million (in June) for a Series A round. Reliance Industries, an India-based oil and natural gas developer and provider, was the sole funder. |

| Airmap | 15.0 | A Santa Monica, CA provider of airspace info for airports and drone operators, got $15 million for a Series A funding led by General Catalyst Partners. |

| Chronocam | 15.0 | A French startup developing bio-inspired vision systems for autonomous vehicles, received $15 million in a Series B round led by Intel Capital, Renault, 360 Capital Partners, iBionext Growth Fund, and Robert Bosch Venture Capital. |

| Mojio | 15.0 | A Canadian startup and provider of an open platform for connected cars, raised $15M in a two-part Series A round backed by Amazon Alexa Fund, Deutsche Telekom, BDC Capital, Relay Ventures, and BC Tech Fund. This new funding will further the global adoption of Mojio’s hardware-agnostic, cloud-based connected-car platform and enable hiring in Palo Alto, Prague and Vancouver. |

| Savioke | 15.0 | A Silicon Valley startup headed by Steve Cousins, previously the CEO at Willow Garage, received $15 million from Intel, EDBI and Northern Light. Savioke's Relay delivery robots are now placed in 5 hotel chains and have added coffee to the arsenal of things it can deliver. In 2015, over 11,000 deliveries were made with Relay robots. |

| Shenzhen Gowild Robotics | 15.0 | A Shenzhen AI and personal robot startup, raised $15 million in a Series A round. Their new mobil robot goes on sale in 2017 for around $860. |

| Delair-tech | 14.5 | a French UAS startup, got $14.5 million from Andromède, a French VC. Later in 2016 Delair acquired Gatewing from Trimble. Read more. |

| Foghorn Systems | 14.5 | A developer of IoT software for industrial and commercial vertical markets, got $14.5 million from March Capital, GE Ventures, The Hive and the VC arms of Bosch, Darling and Yokogawa Electric. FogHorn is developing edge intelligence AKA "fog computing”. The company's fog computing platform is a critical enabler for a new class of powerful real-time analytics, machine learning models and edge computing applications in a wide variety of industrial and enterprise use cases. |

| Bossa Nova | 14.0 | A Pittsburgh-based developer of B2B mobile robotic technology, raised $14 million in a Series A funding led by WRV Capital. Funds will be used to deploy its mobile robots in retail stores for inventory taking. |

| Saildrone | 14.0 | An Alameda, CA startup, raised $14M in a Series A funding round led by Social Capital with additional funds from Capricorn Investment and Lux Capital. The funding will be used to expand Saildrone's fleet of marine drones, enhance Saildrone's data processing capacity, and scale commercial operations. |

| SimToo | 13.6 | A Shenzhen-based UAS startup, raised around $13.6 million in a Series B round led by Renmin Group, Duoniu Media, Lanhai Ark and Hanjing Family Office, all Chinese VCs. SimToo makes a foldable follow-me hands free camera quadcopter called a Dragonfly. Priced at $443, Dragonfly has sold over 20,000 units via online and offline channels and the company expects to realize a profit this year. |

| Jibo | 13.1 | The much delayed social robot developed by MIT’s Cynthia Braezeal, raised $13.1 million and are continuing the search for an additional $15 million. Jibo has raised $65.4 million thus far. Ther most recent announcement delayed shipments until November for people willing to be Beta testers and didn’t say when fully functioning Jibos will ship to those early buyers that don’t want to Beta test (I am one of these). |

| Drive.AI | 12.0 | A Silicon Valley AI startup founded by former graduate students out of Stanford University’s Artificial Intelligence Lab, is using deep learning methods to provide solutions for autonomous vehicles from perception to motion planning to controls. Drive.ai got $12 million in equity funding from undisclosed sources. (Drive.ai is not to be confused with DriveAI, a NJ non-profit working on similar activities and funded by an insurance company.) |

| Nauto | 12.0 | A Silicon Valley autonomous vehicle technology startup, raised $12 million. Playground Global and Draper Nexus were the funders. Nauto is developing data storage similar to airline black boxes: stored sensor and visual data to help fleet managers and insurance companies detect and understand the cause of accidents and reduce liability claims. |

| Seegrid | 12.0 | A maker of vision-based autonomous industrial vehicles and systems, announced today that the company has raised approximately $12M of equity capital from Giant Eagle, its majority shareholder, and several other existing and new investors, and has a commitment for an additional $13M from Giant Eagle as needed. |

| Movendo Tech | 11.0 | An Italian startup based in Genoa, raised around $11 million to develop a specialized robotic rehabilitation platform. Sergio Dompé was the primary investor. The new company will develop, manufacture and market medical devices at a site in Genoa, near IIT, The Institute of Italian Technology, where the first product (Hunova) will be developed, assembled and then introduced to European and US markets. |

| Resson | 11.0 | A global ag data analytics startup, raised $11 million in a Series B round led by Monsanto Growth Ventures. Other investors include a group of Canadian early stage investors. |

| Sarcos Robotics | 10.5 | A Salt Lake City maker of military exoskeleton robots, secured $10.5 million in funding from Microsoft, Caterpillar Ventures, GE Ventures, Cottonwood Technology Fund and two unnamed private investment firms. Sarcos says it will use the funds to grow its team and bring its Guardian line of robotics to market. Beyond the obvious military applications, Sarcos envisions possibilities for the machines in a number of industries, ranging from oil and gas to mining to construction and manufacturing. |

| Dedrone | 10.0 | A German startup whose DroneTracker drone detection platform, raised $10 million in a Series A funding from a series of EU and Silicon Valley VCs. In just 15 months, Dedrone has grown to more than 40 employees and 100 distributors in over 50 countries. |

| Emotech | 10.0 | The UK-based maker of the Olly robot, a product similar to Amazon's Echo device, has raised $10 million from Chinese venture investors Alliance Capital and Lightning Capital. |

| GreenValley Intl | 10.0 | Renamed from True Reality Geospatial, a provider of satellite and drone data and analytics, raised $10 million in a Series A round led by Northern Light Ventures and including SF Investments. |

| Hortau | 10.0 | A California soil moisture monitoring company which raised $10 million to grow and broaden their new system of networked field sensors, weather stations and control units allowing growers to remotely open and close valves and fire up engines for irrigation from cloud-based management software. |

| Petnet | 10.0 | A Los Angeles startup providing personalized feeding for pets, raised $10 million in a Series A financing. Petco led the round. |

| Rapyuta Robotics | 10.0 | A Swiss and Japanese A.I. startup and spin-off from Zurich's ETH, got $10 million in a Series A round. Rapyuta is developing and building multi-robotic systems for the security market and is aiming to commercialize the RoboEarth project of enabling robots to talk and learn with and from other robots over the cloud. |

| Kraken Sonar | 9.8 | A Canadian startup providing sonar, sensors and underwater robotics systems. |

| Superflex | 9.6 | A Silicon Valley spin-off from SRI International, raised $9.6 million in a Series A round led by Japanese venture firm Global Brain with additional participation from seed investors Horizons Ventures and Root Ventures, and new investment from Sinovation Ventures. Superflex is developing a new category of lightweight, connected apparel, worn under any outfit, with integrated electric “muscles” that add intelligent wearable strength and natural mobility to muscles and joints, enabling everyone — from seniors, to athletes, to chronically ill children — to achieve their full physical potential. |

| Innoviz Technologies | 9.0 | An Israel-based developer of sensors and systems for autonomous vehicles, raised $9 million in Series A funding. The round included Vertex Venture Capital, Magma Venture Partners, Amiti Ventures, and Delek Investments. |

| Sentera | 8.5 | A Minneapolis-based integrator of aerial data and analytics software, raised $8.5M in a venture capital round with a group of undisclosed strategic investors. |

| Locus Robotics | 8.0 | Locus is a Massachusetts-based company founded specifically in answer to Kiva Systems' robots being taken inhouse by Amazon and no long available to non-Amazon clients. Locus' founder is a Kiva-using distribution center owner, who, as a consequence of Amazon's actions, had no recourse other than to build a company that uses a fleet of robots integrated into current warehouse management systems to provide robotic platforms to carry picked items to a conveyor or to the packing station thereby reducing human walking distances and improving overall picking efficiencies. |

| PraFly | 8.0 | Based in Shenzhen, PraFly develops intelligent control system solutions for robotic applications including restaurant server robots. PraFly received $8 million from Intel. Other PraFly products are used in energy management, in-vehicle systems, intelligent couriers, intelligent manufacturing, smart kitchens and driving training. |

| Tempo Automation | 8.0 | A San Francisco prototype chip manufacturer, got $8 million in a Series A funding round led by Lux Capital, along with SoftTech, AME, and Bolt, to improve its manufacturing facility, which is already at capacity. |

| MicaSense | 7.4 | A Seattle-based agriculture sensor maker, raised $7.4 million from French drone and electronics company Parrot. The recent round piggybacks on Parrots’ previous $2m investment in the company in 2014. MicaSense creates sensor devices that attach to drones. RedEdge, its first product, is a multispectral camera able to capture data over precise wavelengths. |

| Titan Medical | 7.2 | A Canadian startup involved in the design and development of a robotic surgical system, completed a public offering which raised $7.2 million. John Hargrove, Titan’s CEO, said: “We believe we have [with these new funds] sufficient funds on hand to enable us to move forward with the advancement of human factors and usability studies of the surgical system." |

| Arevo Labs | 7.0 | A 3D printer using composite materials for production applications raised $7M in a Series A funding round led by Khosla Ventures. Arevo enables direct digital additive manufacturing of ultra strong composite parts for end-use applications using robot-mounted 3D printers. |

| Prospera | 6.8 | An Israeli startup collecting and providing tools to help growers understand newly available data using computer vision, data science, and machine learning to monitor and analyze crops. Prospera raised $6.75 million in Series A funding in a round led by Israeli VC Bessemer Venture Partners. |

| Civil Maps | 6.6 | An Albany, CA developer of high definition 3D maps and centimeter-level localization, got $6.6 million in a seed round from Ford, Motus Ventures and three others. |

| Hangar Technology | 6.5 | An Austin, Texas-based developer of autonomous data capture using drone technology, has raised $6.5 million in seed funding led by Lux Capital. Hangar is presently in hiring mode and beta testing its drone photography on real estate sites. |

| PRENAV | 6.5 | A Silicon Valley unmanned aerial systems startup, raised $6.5 million in seed financing from lead investor Crosslink Capital, along with Haystack, Liquid 2 Ventures, WI Harper Group and investors Pear Ventures, Toivo Annus, and a number of other investors. |

| ACSL | 6.4 | (Autonomous Control Systems Lab), a Chiba University spinoff, is a robot-, drone- and map-making startup which raised $6.4 million from UTEC and Rakuten (a snack and drink provider). Funds will be used to scale up to handle delivering drinks and snacks on golf courses by drone. |

| Disruptive Technologies | 6.2 | A Norway-based developer of wireless sensors for a variety of automation uses including IoT, raised $6.15 million in equity funding from Ubon Partners, an Oslo/European investment company. |

| 6 River Systems | 6.0 | Raised $6 million in seed funding from VC firms Eclipse and iRobot Ventures. Founded in 2015 by former Kiva Systems and Mimio executives and based in Boston, 6 River is developing next-gen mobile robot fulfillment solutions for distribution centers. |

| Fastbrick Robotics | 6.0 | An Australian robotic brick-laying startup raised $6 million from Hunter Hall Investment, an Australian VC. |

| Sky-Futures | 5.7 | Got $5.7 million in a series A funding from the Bristow Group and MMC Ventures. Sky-Futures is a drone inspection service for the oil and gas industry. |

| 5D Robotics | 5.5 | Raised $5.5 million in a seed round from private investors to enable the development of their commercial equipment automation business efforts which include mapping, inspection and providing vision and mobility systems for industrial heavy equipment. 5D Robotics is also a provider of centimeter level UWB radios and mobile positioning systems for defense applications. |

| Vision Labs | 5.5 | A Russian vision systems startup, raised $5.5 million in a Series A round from Sistema Venture Capital. The company’s core product is a recognition platform - VisionLabs LUNA - which allows near real-time recognition of millions of faces from video and photo streams in order to identify people. |

| Eonite Perception | 5.3 | A Silicon Valley vision systems startup, raised $5.25 million in a seed round from multiple Silicon Valley VCs. Eonite is building a 3D mapping and tracking system for the virtual reality marketplace using low latency dense depth sensors. |

| Optimus Ride | 5.3 | A Boston-based developer of autonomous driving technology, has raised $5.25 million in seed funding co-led by NextView Ventures and FirstMark Capital. |

| SlantRange | 5.0 | A San Diego startup that provides sensors, computer vision and analytics to the agriculture industry, raised $5 million in Series A funding from The Investor Group, a large family-owned agriculture company in the Mid-West, and a Silicon Valley venture capital firm. SlantRange sells sensors and licenses its analytics software. |

| uAvionix | 5.0 | A Palo Alto-based developer of aviation communication, navigation and real-time sense and avoid systems, raised $5 million in Series A funding led by Playground Global, the VC firm headed by Andy Rubin of Android and Google's robot acquisitions fame. |

| Restoration Robotics | 4.8 | The robotic hair transplant company, got $4.82 million equity funding from Octa Finance, according to Restoration's SEC filed Form D. |

| LifeRobotics | 4.4 | A Tokyo-based startup developing a narrow one-armed co-bot, raised $9 million in a Series B funding from Global Brain, Mitsui Fudosan, Koden Holdings, Mizuho Capital and Golden Asia Fund. Funds will be used to scale up for mass production of the co-robot and improving services for customers. LifeRobotics raised $4.4 million earlier this year. |

| Flyability | 4.3 | Got $4.3 million from a Series A funding from MKS Alternative Investments, Go Beyond Investing, and Environmental Technologies Fund. Flyability, a Swiss startup, develops Gimball, a collision-proof drone for new applications in inspection, rescue and security. |

| Modbot | 4.0 | A San Francisco startup, raised $4 million in a seed round led by Visionnaire Ventures and included Eclipse, AME Cloud Ventures, Morado Ventures and Autodesk, Inc. |

| Uvify | 4.0 | A Korean drone startup, got $4 million from KCube Ventures and NCsoft. |

| Blackmore Sensors & Analytics | 3.5 | A Montana startup, has raised $3.5 million to build LiDAR systems that can help vehicles see more details about what’s in front of them than existing sensors do today. Next Frontier Capital led and was joined by Millennium Technology Value Partners. The company spun out of a research and development firm called Bridger Photonics that developed LiDAR systems for micron-precise laser cutting and welding,and then for military surveillance. |

| Gamaya | 3.2 | A Swiss aerial analytics spin-off from the Swiss EPFL, raised $3.2 million in a Series A funding. Funds will be used to develop their new 40 bands of light hyperspectral imaging sensor and analytics software platform (traditional multi-spectral sensors have 4 bands). |

| Comma | 3.0 | A San Francisco startup headed by George Hotz, the hacker who, at age 17, was the first person to unlock an iPhone, and at 21, cracked the encryption schema on the PlayStation3, got $3 million in funding from Andressen Horowitz and others for his plans to produce a self-learning, self-driving kit for under $1,000 and deliver that kit by the end of 2016. That plan changed when Hotz rankled at NHTSA when they formally asked him about safety considerations within his software. Read more. |

| SkySafe | 3.0 | A San Diego startup whose technology can disable drones that are flying where they shouldn’t, raised $3 million in seed funding. Andreessen Horowitz led the round, with participation from Founder Collective and SV Angel. The FAA estimates there will be 2.5 million drones sold in the U.S. alone just this year, hence the need to establish boundaries and identify and perhaps disable those that trespass. |

| ecoRobotix | 3.0 | A Swiss ag startup with a sensor-laden solar-powered mobile robot, raised $2.97 million led by 4FO Ventures and Investiere.ch, a platform for online investment, and Business Angels Switzerland. |

| Cyberhawk | 2.9 | Raised $2.9 million in financing to enable UK-based Cyberhawk to expand its commercial development of the drone-captured data inspection market for the oil & gas industry and infrastructure markets. |

| FiveAI | 2.7 | A UK start-up using artificial intelligence and machine learning to accelerate the arrival of fully autonomous vehicles, got $2.7 million of equity funding in a round led by Amadeus Capital Partners. |

| Navisens | 2.6 | A SF software, systems and AI startup, got $2.6 million in seed funding in a round led by Resolute Ventures with participation from KEC Ventures, Amicus Capital, Arba Seed Investment Group, and angel investor Gokul Rajaram. The company is introducing its patent-pending technology, motionDNA, a location solution that employs motion sensors for both indoor and outdoor location solutions. |

| Astrobotic Technology | 2.5 | The CMU spin-off is working on delivering payloads to the moon, raised $2.5 million from Space Angels Network. Astrobotic has 10 projects with governments, companies, universities, non-profits, NASA, and individuals for their first moon mission. |

| MegaBots | 2.4 | An Oakland, CA entertainment startup, raised $2.4 million in seed funding to bring robot-fighting to a venue near you. MegaBots plans to use the seed funding to build their robot for the fight against the Japanese team they’ve challenged; and to secure sponsorships, perhaps even a TV contract for a program that tracks the team from building the robots to competing. |

| Varden Labs | 2.2 | A SF self-driving car startup and Y Combinator Winter participant, raised $2.2 million in a seed round led by Maven Ventures and included additional money from Funders Club. |

| Sunflower Labs | 2.1 | A Silicon Valley startup raised $2.1 million in a seed funding round led by General Catalyst and other unknown funders. Sunflower is designing home security sensors, apps and products including a smart drone. |

| Auro Robotics | 2.0 | A San Francisco-based autonomous campus shuttle service, has raised $2 million in Series A funding. Motus Ventures led the round, and was joined by Rothenberg Ventures. Auro's driverless shuttles can be used on university campuses, in retirement communities and at resorts. |

| Dispatch.AI | 2.0 | A SF-based startup offering a 150-pound delivery robot, got $2 million in seed funding from Andreessen Horowitz and Precursor Ventures. The new “Carry” robot has 4 compartments and can carry a total of 100 pounds. The vehicle can do multiple deliveries per trip. Pilot programs are ongoing at Menlo College and CA State U Monterey Bay to deliver students their mail, packages and other things. Once the robot rolls up, students can unlock and access their package using their phone. |

| Tend.AI | 2.0 | An Oregon startup providing cloud software robots tending multiple 3D printers, raised $2 million in seed funding from True Ventures, a SV early stage VC. |

| AI-Robotics | 1.8 | A Beijing medical robotics and exoskeleton startup (not to be confused with Israeli startup Airobotics), got $1.8 million in a seed round. |

| Autonomous Marine Systems | 1.6 | Got $1.6 million in a seed round that enabled a $1.9 match-grant funding with all the funds going towards fulfilling DoD contracts to provide long duration ocean observation. |

| Primo Toys | 1.6 | A London-based startup, got $1.6 million from their Kickstarter campaign for their Cubetto coding/robot system for kids. 6,553 backers contributed. |

| Blue Ocean Robotics | 1.5 | A Danish VC and accelerator, announced that an anonymous private investor bought 6.7% of Blue Ocean shares for $1.5 million. Blue Ocean intends to sell over 33% of their shares to get funds to finance their rapid growth (from 3 people in 2013 to 110 people today, plus 21 associated companies in 11 countries). |

| AGERPoint | 1.2 | Got $1.2M in a venture capital round. AGERpoint provides information management solutions to tree and vine crop growers. Based in Orlando, FL, the company’s platform includes data acquisition, analytics, and action scenarios for growers. |

| OnRobot | 1.0 | An Odense, Denmark startup that manufactures a grasping device that can easily adapt to Universal Robots and other co-bots, got around $1M in equity funding from Enrico Krog Iversen, Thomas Visti and The Danish Growth Fund. |

| SkySquirrel Technologies | 1.0 | Got $1 million in seed funding. The Halifax Nova Scotia startup is focusing on agricultural crop analytics. |

| Farmbot | 0.8 | A Central California startup offering an open source DIY robot and system for home gardens, raised $813,000 from a crowdfunding campaign. |

| Woobo | 0.8 | A stealthy startup in Boston, received $800k from Kunlun (AKA Kalends), a Chinese provider of online games and software apps. |

| Deveron Aviation | 0.6 | A Canadian mineral resources company listed on the Toronto Ventures OTC market, acquired a UAS company and is repositioning itself as a UAS service provider. Deveron finalized a non-brokered private placement financing of $550k. |

| IAM Robotics | 0.5 | A Pittsburgh, PA logistics technology startup, got $450k in convertible debt funding from Comet Labs. |

The following companies were also funded but didn't provide details: Raptor Maps, OnFarm, Appolo Shield, Aarav Unmanned Systems, AIO Robotics, Aloi Material Handling, Aurora Flight Sciences, Kimera Systems, NVBots, OPS-Ingersoll, OptoForce and Square Robot.

[If you have information about robotics-related fundings, or corrections or additions to that which is reported above, please email it to info@therobotreport.com. Thank you.]

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product