Industrial Robots market slows in 2019 but long-term forecast is positive – Interact Analysis

Market intelligence firm Interact Analysis has released a new market report focusing on the industrial robot market. The research outlines reasons to be positive in the sector, despite an immediate, short term decline in revenues.

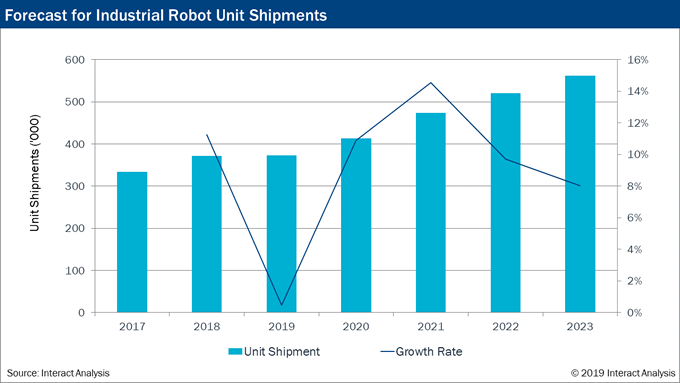

The report goes into detail around specific headwinds that have challenged growth within the sector, including the slowing global economy, trade wars and uncertainty in the global automotive industry. Compared to 2017, where revenues associated with industrial robots increased by 20%, forecasted declines of 4.3 per cent in 2019 have caused some concern.

Jan Zhang, research director at Interact Analysis, said: “Automotive and smartphone production declines play a significant part in this downturn. As the largest end-user segment for industrial robots – accounting for over 30% share of revenues – any downturn in this area is always keenly felt in automation and robot investment.

“Despite this, however, there are reasons to be optimistic. Long term drivers, both for industrial robots and for automation as a whole, remain very strong. Growth is expected to pick up on 2020, and then accelerate further in 2021 due to new industry applications, lower prices and wider use cases.”

The report’s findings, based on interviews with all leading robotics companies (as well as a wide selection of innovative robot start-ups, system integrators and component suppliers), highlight the importance of new robot types in fuelling this growth. In particular, cobots – collaborative robots – which work alongside humans are finding favour in industries not traditionally associated with the use of robots. Among those industries identified are food and beverage, logistics, packaging and life sciences.

“Growth in these industries can’t fully compensate for the decrease in the automotive industry, but it does warrant optimism for the future,” said Jan.

A central element to the report’s findings is the impact China is having on the global industrial robot market in 2019. While Japan remains the largest producer of industrial robots, with an estimated 45% of total production, there has been significant growth in production capacity and output in China. This can be attributed a number of factors, including Chinese vendors entering the market and inward investment from traditional industrial giants like ABB, Fanuc, KUKA and YASKAWA.

Jan added: “While it is true growth of industrial robot revenues has slowed down, the reasons for this are clear and, for the most part, beyond the control of the vendors. Despite this, however, there is evidence that the industry is diversifying and putting the foundations in place for significant future growth, making this one of the more exciting spaces to operate in.”

###

About the Industrial Robot Report – 2019

Interact Analysis uses a rigorous methodology to produce as accurate a report as possible. For the Industrial Robot report, over 30 face-to-face and telephone interviews were undertaken with key industry personnel at leading industrial robot companies, as well as robot system integrators and components suppliers. Additionally, real company data was collected via surveys which maintained confidentially to create a bottom up model of total industry sizes, as well as market share analysis. The entire report is underpinned by the extensive industry data available in Interact Analysis’ Manufacturing Industry Outlook tracker – an economic database developed internally using national surveys of manufacturing from 34 of the largest manufacturing economies in the world. The data was combined under a common taxonomy to give a like for like comparison between regions/industries and to provide better accuracy when developing forecasts.

About Interact Analysis

Interact Analysis is an international provider of market research for the Intelligent Automation sector. Our team of experienced industry analysts delivers research into three core sectors: industrial automation, robotics and warehouse automation, and commercial vehicles. Intelligent Automation – which is the integration of artificial intelligence and automation – will change virtually every industry imaginable. This combination enables greater efficiencies, productivity, convenience and scale. It has the potential to drastically alter the outlook for many traditional industries such as manufacturing, healthcare and automotive as well as to lead to the emergence of entirely new industries. To learn more, visit www.interactanalysis.com

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product