Mobile Robot Market Grew by 33% in 2022 – Over 120,000 AGVs and AMRs Sold

.jpg)

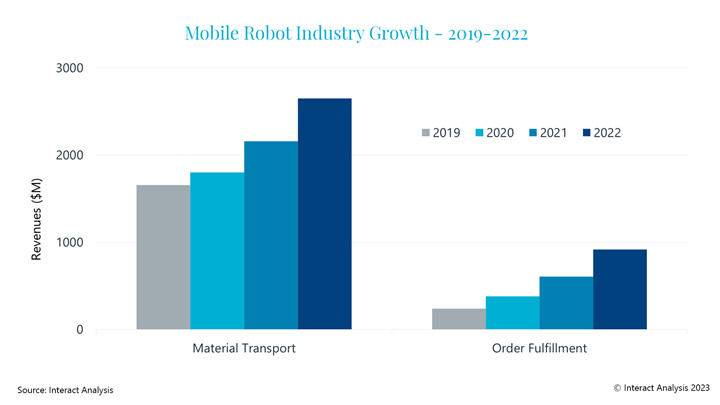

The mobile robot industry continued to defy the global economic slowdown and grew by 33% in 2022, with more than 120,000 AGVs and AMRs shipped during the year generating $3.6bn in revenue. Despite weakness in the global economy, high interest rates and inflation, we predict shipments will grow by a further 45% in 2023 and more than 30% in 2024.

While the main customers of mobile robots – manufacturers, retailers and logistics companies – have been generally tightening their belts amid a backdrop of weak consumer confidence and other headwinds, the drivers of automation have never been stronger. Companies continue to invest in AGVs and AMRs to combat labor shortages, reduce operating costs, speed up operations, and maintain a competitive advantage.

The mobile robot market is a diverse industry with a multitude of form factors, styles and technologies automating an even wider range of workflows and processes across almost every sector imaginable. Unsurprisingly perhaps is that the most commonly sold mobile robot last year was automated conveyors for performing point-to-point material moves. Nearly 40,000 of these robots – which can carry payloads as low as 20kg and as much as several tons – were shipped in 2022 and more than 50,000 are predicted to be sold this year. The wide use cases that currently rely on manual operations, coupled with the huge amount of point-to-point material movement that occurs in warehouses and factories, means that this number is still a tiny fraction in terms of total market penetration and will grow considerably in the coming years.

Strong revenue growth in recent years for both material transport and order fulfilment robots

Similarly, shipments of Kiva-like, shelf-to-person robots from vendors such as Geek+ and GreyOrange continued to grow strongly in 2022, with more than 30,000 sold (excluding any produced and installed by Amazon). These robots are being rapidly adopted by retailers and 3PLs, particularly in China, and more than 40,000 are expected to be shipped and installed in 2023. Shelf-to-person robots have been around for over a decade (which is a lifetime given the pace at which the technology is developing), and are now starting to be displaced by the next generation solution – tote-to-person. These robots, which have been developed by companies like Exotec, HAI Robotics and Geek+ offer the same benefits of shelf-to-person robots but with much greater storage densities as they can reach as high as 12 meters. This allows retailers and 3PLs to squeeze much more productivity and throughput out of a smaller sized warehouse. While starting from a low base, demand for these robots is growing rapidly, with nearly 15,000 expected to be sold this year, and it is expected to increase at a pace of nearly 70 percent a year over the next five years.

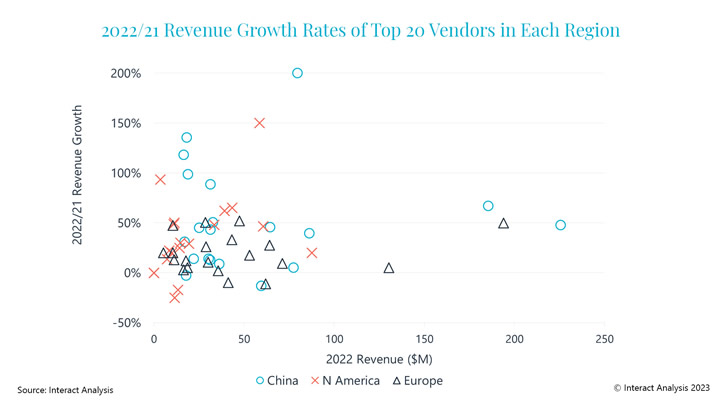

As in previous years, vendor performance varied hugely in 2022 due to vastly different growth rates seen within the different product segments. For example, revenues from person-to-goods AMRs nearly doubled in 2022, while those from automated tow tractors were flat. 2023 will be no different and vendors will largely ride the waves of growth within their product sectors. All of the top 3 vendors (Geek+, KION, and HiKRobot) performed well in 2022 and gained nearly 3 percentage points in market share.

Strong revenue growth for many leading mobile robot vendors in China, North America and Europe during 2022

Although the outlook for the wider economy is decidedly turbulent, the outlook for mobile robots remains very positive indeed as customers’ automation plans continue as a long-term strategy to remain competitive. We predict that global revenues will reach $6bn next year, with nearly a quarter of a million mobile robots sold!

For more information on the mobile robot market and Interact Analysis’ latest report, please contact Ash Sharma, Managing Director.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product