Beyond Industrial Arms: How Service Robots Will Become Everyday Infrastructure by 2034

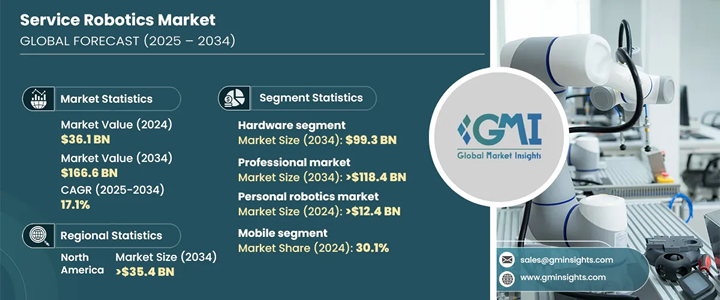

By 2034, the service robotics market is projected to surpass USD 166.6 billion, but the headline number only hints at the deeper shift underway: robots are moving from novelty to necessity. Over the next decade, service robots will weave themselves into daily life—delivering meals in dense cities, disinfecting hospitals, patrolling warehouses, tending crops at midnight, and guiding seniors safely around the home. What follows is a grounded look at why growth will accelerate, where the value concentrates, and how organizations can capture returns while managing risk.

Why demand is compounding now

Three forces are converging:

- Labor scarcity and cost pressure. Aging populations, shrinking working-age cohorts, and persistent shortages in logistics, healthcare, and hospitality make automation not a luxury but a staffing strategy. Robots don’t replace empathy or expertise; they offload repetitive, low-skill tasks so people can do higher-value work.

- Maturity of enabling tech. Edge AI, better batteries, affordable depth cameras and lidars, robust SLAM navigation, and 5G/wi-fi 6 connectivity unlock reliable autonomy in messy, unstructured environments—offices, farms, and city streets, not just factory floors.

- Proven ROI paths. Early pilots showed promise; late-2020s cohorts delivered repeatable savings. Cleaning robots logging thousands of hours, last-mile bots slashing delivery times, and telepresence carts cutting readmission risk have shifted executive attitudes from “if” to “how fast.”

Where the robots will work—and win

Healthcare & eldercare. Medication delivery, bed-linen transport, ultraviolet disinfection, and mobility assistance are the near-term sweet spots. Companion and rehab robots will augment clinicians by encouraging adherence, monitoring vitals, and reducing routine trips. As care moves to the home, compact service bots will support activities of daily living—fetching objects, detecting falls, and calling help.

Retail & hospitality. Inventory-scanning bots, shelf-analytics rovers, and back-of-house runners reduce shrink and stockouts while freeing staff for customer engagement. In hotels and hospitals, autonomous carts shuttle linens, meals, and supplies—24/7, safely through elevators and corridors.

Logistics & last mile. Sidewalk robots, autonomous delivery carts, and yard-shuttling tugs compress the cost and time of short-haul movement. Inside facilities, autonomous mobile robots (AMRs) handle zone-to-zone transfers, replenishment, and returns—integrating with WMS and ERP systems to adapt in real time.

Public spaces & smart buildings. Security patrol bots with computer vision detect hazards, leaks, intrusions, and smoke. Cleaning robots shift from fixed routes to dynamic, sensor-informed tasks—concentrating on high-traffic zones as occupancy changes through the day.

Agriculture. Swarm sprayers, weeding bots with machine vision, and micro-harvesters cut chemical use, boost yield, and extend working hours beyond human-friendly dayparts. For mid-sized farms, leasing will make advanced capabilities accessible without heavy capex.

Education & service learning. Telepresence and tutor robots won’t replace teachers; they’ll scale presence—connecting specialists to rural schools, enabling hybrid labs, and supporting special-needs classrooms with predictable routines.

The tech stack that makes it possible

- Perception: Multimodal sensing (RGB-D, radar, tactile) fused with transformer-based models improves obstacle classification in low light, rain, and clutter.

- Planning & control: Modern planners combine global maps with on-the-fly local avoidance; reinforcement learning shortens edge-case handling in crowds and elevators.

- Software infrastructure: ROS 2 has matured for security and real-time performance; vendors layer fleet management, OTA updates, and remote ops consoles on top.

- Connectivity: Private 5G and advanced wi-fi stabilize handoffs across floors and buildings, while APIs integrate robots with BMS, elevators, doors, and alarms.

- Power: Denser batteries and smart charging (including opportunistic dock-and-dash) enable multi-shift availability without large human overhead.

Business models that unlock scale

The most successful vendors won’t just sell robots; they’ll sell outcomes.

- RaaS (Robotics-as-a-Service): Subscription bundles hardware, software, maintenance, and SLAs tied to measurable outputs—square meters cleaned, orders delivered, hours patrolled—shifting spend from capex to opex and aligning incentives.

- Vertical playbooks: Pre-integrations with hospital EHRs, retail planogram systems, or warehouse WMS reduce deployment time from months to weeks.

- Ecosystem partnerships: Elevator manufacturers, door controllers, and building-access providers become channel partners, smoothing cross-vendor interoperability.

Regional dynamics

- Asia–Pacific will remain the largest and fastest-moving arena, with dense urban cores, aging populations, and a manufacturing base that compresses design-to-deployment cycles.

- North America will lead in software, autonomy, and integrated services, particularly in healthcare, warehousing, and quick-serve restaurants.

- Europe will shape standards for safety, privacy, and human-robot interaction—crucial for public trust and cross-border rollout.

Barriers to navigate—honestly

Growth to USD 166.6 billion doesn’t happen automatically. Leaders must tackle:

- Safety and standards. Compliance with ISO 13482 (safety requirements for personal care robots) and machine directives is non-negotiable. Robust fail-safes, speed limits near people, and certification pathways are table stakes.

- Systems integration. Many pilots stall because robots can’t talk to elevators, badge readers, or legacy software. Demand vendors show working integrations and a clear roadmap.

- Cybersecurity & privacy. Vision data is sensitive—especially in hospitals and schools. Favor edge processing, data minimization, encrypted storage, and role-based access controls. Ask for third-party security audits.

- Change management. Robots succeed when staff see them as teammates. Invest in training, job redesign, and transparent metrics that credit human-robot collaboration for outcomes.

- Unit economics. Evaluate total cost of ownership: acquisition or subscription, maintenance, spares, downtime risk, software fees, and expected lifespan. Insist on ROI models tied to your workflows—not generic benchmarks.

What adopters should do now

- Start with a specific job. Pick a narrow, repetitive task with clear KPIs—room disinfection, shelf scanning, or corridor delivery—before scaling.

- Design the “handoff.” The seam where a robot’s output becomes a human’s input (or vice versa) determines real productivity. Map it, improve it.

- Pilot with purpose. Run time-boxed trials with baseline metrics, success thresholds, and an exit or expansion plan. Capture qualitative feedback from frontline teams.

- Build an integration spine. Budget for connectors to elevators, doors, BMS, WMS, and identity systems. The second robot is always cheaper if the spine is ready.

- Own the narrative. Communicate that robots augment people, improve safety, and elevate jobs. Celebrate employees who become “robot wranglers” and process owners.

The 2034 picture

By 2034, service robots will be as ordinary as HVAC—quiet, persistent infrastructure. Buildings will request cleaning autonomously based on occupancy; hospital corridors will orchestrate supply runs in the background; sidewalk fleets will coordinate with traffic systems; farms will run micro-treatments plant by plant. The winning organizations won’t be those that buy the most robots, but those that re-engineer workflows around them, integrate them cleanly, and measure outcomes obsessively.

The market crossing USD 166.6 billion is exciting. The transformation it represents—safer hospitals, more resilient supply chains, dignified aging, reduced waste in agriculture—is the real story. Service robots are not coming to take jobs; they’re coming to take on jobs people shouldn’t have to do. The sooner leaders plan for that division of labor, the faster they’ll turn automation from a gadget into a competitive advantage.

Source: https://www.gminsights.com/industry-analysis/service-robotics-market-size

Featured Product