Just like at Automatica last summer, it almost felt as if the robotics event was morphing into an IT event. So much so that Michael Loughlin of nelmia Robotics Insight joked that it looked like manufacturers forgot that their job is actually to build stuff.

RoboBusiness 2016: Our Takeaways

Samuel Bouchard | Robotiq

Reprinted with permission from the Robotiq blog:

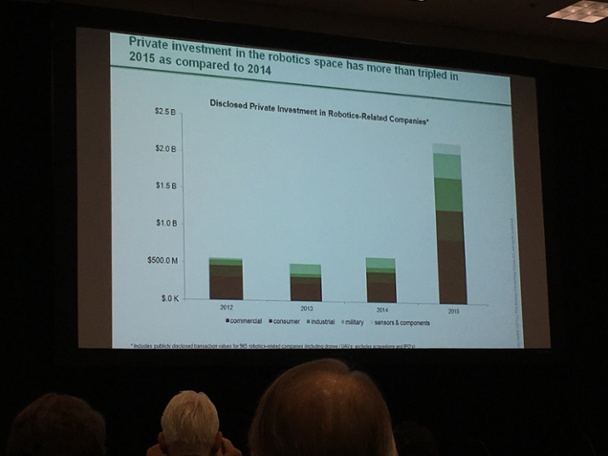

We’re back from our yearly sync with the robotics industry happening at RoboBusiness. As usual, there were great talks and great people to meet. To be honest, it felt less frenzied this year than in the previous two to three events. Are people becoming more realistic about the promise of robots or am I just becoming immune to the ambient buzz? There were a lot of local players who were not at the event. Maybe they’re just busy working at making their stuff work after a surge of investment, as shown in the Boston Consulting Group presentation.

What’s Different this Year?

Last year’s trending topic was logistics. There was still a decent amount of content about the topic this year. While connected robots and AI were only touched upon in 2015, they seemed to show up in every second session this year. In 2014, Jibo was announced and this year we saw various similar ideas from companies during the Pitchfire. In 2013, telepresence was a hot topic; this year, it was totally off the radar (no beams were running around).

Theme of the Year: IoT

Just like at Automatica last summer, it almost felt as if the robotics event was morphing into an IT event. So much so that Michael Loughlin - Founder and CEO of nelmia Robotics Insight - joked that it looked like manufacturers forgot that their job is actually to build stuff.

James Kuffner, from Toyota Research, started the show with his keynote on cloud robotics and how it’s been enabled by pervasive broadband communication and the public cloud. FANUC drew a lot of interest with their Zero Downtime (ZDT) system that combines connected robots and business processes to make sure that all robots are repaired before they go down. Omron and Rethink were also there to present their vision of what it means to connect robots. It brought up many interesting questions about data ownership, the role of the integration channel and the many ecosystems that might arise from connecting robots.

Close Second: Artificial Intelligence

Kuffner also touched on this topic in his keynote address, explaining that while we have plenty of powerful open source AI, what we now need is good data. A more realistic Sachin Chitta, from Kinema Systems, explained that deep learning in computer vision has a long way to go. We need to know where something is as much as what it is. The massive quantity of data required for applying deep-learning techniques is not easy to get (you can't scrub it off the web). On the medical side, Verb Surgical explained how they plan on using the sharing of data and AI to help doctors operate, perceive and make decisions. Again, will they be able to get the amount of data that the new deep learning algorithms require? If they can, they will be on their way to democratizing medicine and transforming the art apprentices learn from experts into a science purely based on data.

2016 Pitchfire

It definitely takes guts to get on stage and pitch your startup idea in two minutes to a panel of VCs and a crowd of attendees. Kudos to the ones who did it (Catalia Health, Parihug, Genesis Dimensions, Franklin Robotics, Kobi, Cubit, Endurance Robotics, Luxrobo, Iris Automation, QQQ Tech, Scanse, Rokid, Moti and Semio).

For the most part, the pitches were really well done. Kobi Company, the lawn mower, snow blower, leaf blower robot got first place. Coming from a place where we have a lot of snow and leaves to clear, and grass to mow, I was quite surprised by the winning idea, which, to my mind, did not seem realistic at all, both from a technology and a user standpoint. My bet would have been on Catalia Health. Let's wager who will be more successful in three years?

For other companies who wanted to meet VCs one-on-one (which might be wise), there were also VC hours where you could arrange meetings. The pitchfire was sponsored by Siemens who just launched Next47, an initiative to engage further with smaller innovative companies.

Robots in China, What’s the Real Deal?

China has been on everybody’s mind in the robotics industry for a few years now, even more recently with the acquisition of KUKA by Midea. There were two experts at the event to enlighten us about what’s really happening with robotics in China: Tom Green from Robotics Trends and Georg Stieler from STM China.

Bottom line: Yes, there are a lot of robots sold in China, but it’s not as easy as it seems and it’s not growing as fast as the rumors would have us believe (33% CAGR is the goal of the government for the robotics industry. Last year's real growth was 18 percent, and for this year we expect ~10%, albeit on a high level.). The market is different. The lack of integration know-how is slowing adoption. Companies are starting to understand that.

For instance, Bosh is doing integration in China, even though they don’t do it in all of their other markets around the world. Georg had great insight, explaining that the local Chinese robot brands succeed in the simple-use cases but foreign robots are more popular in the more demanding robotics tasks that require high precision and speed.

Cobots Getting Mature

Collaborative robots are now over the hype, entering the plateau of productivity. I was moderating a panel of three interesting speakers. We gathered our notes in this blog post.

Tim Kelch from JR Automation, a large system integrator, presented his view of cobots. The team at JR benchmarked several cobots and installed about a dozen power- and force-limited robots and much more traditional roots in collaborative applications. Tim argued that their simplicity is oversold, showing several TED talks, articles and videos (including one from Robotiq) he felt were responsible for creating the hype and false expectations. Here are a few clarifications:

- Collaborative robots that are simple to program are URs and Rethink.

- KUKA, ABB and FANUC all have collaborative robots but are still programmed with the conventional programming tools targeted to skilled integrators.

- We never proclaimed that cobots were the most innovative robots, quite the opposite. As I mentioned in my presentation at 2013 RoboBusiness, cobots today are tools but not the most advanced autonomous robots – that will become a reality in a few years.

- We’ve also been pretty clear that the simple things are really simple with UR and Rethink. The complex things are more complex than with traditional robots. That’s one of the things that we explain in our Getting started with cobots eBook and talks.

- One place where I do agree with Tim is that integrating the robots with different tooling and machines is where most of the challenge lies today. That’s exactly why we work on making our products plug & play and why we created the DoF community.

A New Building Block for Industrial Robot?

The Harmonic Drive® gear is pervasive in industrial robotics. It’s the component that you find in most industrial robots. Harmonic Drive gears have a quasi-monopoly and represent a significant cost for most robots. That’s why everybody was intrigued to see a potential alternative developed by SRI, only to realize that it has been licensed to, yes, Harmonic Drive.

Does the Robot Industry have an Innovation Problem?

Tony Melanson challenged the robotics industry in the audience, explaining that robots are not the end of the story. It’s obvious that the industry is innovative technologically, making new things that were never possible in the past. But it’s also true that the industry must put the robot in perspective: it’s only one aspect of innovation and that innovation should cover other aspects of the business.

Silicon Valley and Robotics

I am always impressed with the robotics activity in the Valley. At the same time, I am skeptical of the big corporations who follow the herd and open an office there to invest in robotics. Yes, the ecosystem has a lot to offer, but the demand is also really high. In other words, it’s really a red ocean of investors where a few good ones get the best companies and all the rest have lower quality ones. There are a lot of other untapped robotics clusters worldwide that could offer great investment opportunities.

When I compare the environment, with where we are located in Quebec City, I estimate that it would have cost us five times as much to operate Robotiq in Silicon Valley, than it does here in Canada. That means that you would need to get the equivalent financing, growth and value increase to match it. We could definitely not have bootstrapped Robotiq there like we did here. Bootstrapping is not always the best way to go, but it should not be dismissed as a viable route if you’re in it to create a strong company in the long run. As discussed with an investor at RoboBusiness, last year’s most successful IPO was from a bootstrapped company.

RoboBusiness will stay in Silicon Valley next year, save the date: Sep. 27-28, 2017.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product