Demand of Autonomous Delivery Robots May Increase in Coming Years

Autonomous delivery robots are electric-powered motorized vehicles that can transport things or goods to customers without the need for human intervention. These robots are trained to transport a variety of objects from one location to another. Among the items to be supplied are couriers, food, supplies, and other products.

Overview

Autonomous delivery robots are electric-powered motorized vehicles that can deliver items or deliveries to customers without the assistance of a person or supervisor. The sensors and navigation technologies in the autonomous delivery robots allow them to navigate on highways and sidewalks without the need for a driver or on-site delivery workers.

These robots have been programmed to deliver various types of items from one area to another. Couriers, food, supplies, and other goods are among the items to be delivered. Delivery methods have been changed thanks to autonomous delivery robots. They have the benefit of being a very efficient and cost-effective distribution method. Retail, hospitality, healthcare, logistics, and other industries employ autonomous delivery robots the most.

The primary drivers driving the market's growth are lower delivery costs in last-mile deliveries and an increase in venture capital funding. Furthermore, drivers fuelling the market's growth include the worldwide rise of the e-commerce business.

According to a Facts and Factors market research report, the global autonomous delivery robots market was estimated to be USD 17.13 Billion in 2020; and the revenue is expected to reach around USD 55 Billion by the end of 2026, increasing at a CAGR of around 20.4% from 2021 to 2026.

Request a Free Sample Pages from Autonomous Delivery Robots Market Report: https://www.fnfresearch.com/sample/autonomous-delivery-robots-market

Growth Factors

The final phase of product delivery, from the warehouse or distribution center to the end-user, accounts for over 28% of the entire transportation cost in most supply chains. Congestion in urban areas, isolated places, erroneous or erroneous address info, difficult-to-find destinations, and a severe labour scarcity for supplying on-demand delivery services are all variables that affect last-mile delivery. All of these issues are preventing this phase's optimization. Customers in the realm of e-commerce are not just demanding, but they also like to buy high-quality goods at a reduced price. Autonomous delivery robots in e-commerce will not only provide customers with better convenience at a lower cost, but they will also fundamentally alter the competitive landscape.

The current COVID-19 pandemic has shone a spotlight on delivery robots for contactless package deliveries around the world, and strong market demand has pushed delivery robot developers to launch large-scale operations in a number of US locations. During the pandemic, the deployment and adoption of delivery robot technology are projected to strengthen the market for delivery robots. Food is also being delivered by delivery robots from restaurants. Delivery robots have been in use for several years; however, during the epidemic, end users, including restaurants, grocery stores, and other delivery service organizations, have shown a significant increase in interest in them.

Top Market Players

The major market players in the autonomous delivery robots market are Eliport, Boston Dynamics, Robomart, Panasonic System Solutions Asia Pacific, Savioke, Starship Technologies, JD.com, Amazon Robotics, Robby Technologies, and Nuro among others. From January 2017 to December 2020, these companies used a variety of growth tactics to achieve growth in the delivery robots' market, including expansions, partnerships, agreements, and collaborations, which helped them to expand their product portfolio and broaden their client base.

Regional Analysis

North America, Europe, Asia Pacific, and the Rest of the World make up the Global Autonomous Delivery Robots Market. In 2020, North America held the highest market share, and it is expected to grow at a strong CAGR over the forecast period. Many of the leading market vendors are based here, and the region also includes a large number of manufacturers and start-ups devoted to the advancement of autonomous delivery robotic technology. In addition, when compared to other parts of the world, the region has a relatively high penetration of autonomous delivery robots among diverse end-users.

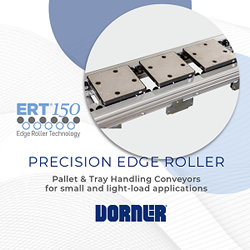

Featured Product

The ERT150 - Dorner's Next Evolution of Edge Roller Technology Conveyors

The next evolution in Dorner's Edge Roller Technology conveyor platform, the ERT®150, is ideal for small and light-load assembly automation, as well as medical and medical-device assembly application. The ERT platform is the only pallet conveyor of its kind available with an ISO Standard Class 4 rating for cleanroom applications. Earning the ISO Standard 14644-1 Class 4 rating means Dorner's ERT150 will conform and not contribute to the contamination of cleanrooms to those standards. As implied by its name, the ERT150 (Edge Roller Technology) uses rollers to move pallets through the conveyor smoothly with no friction (a byproduct often seen in belt-driven platforms). The conveyor's open design eliminates concerns of small parts or screws dropping into rollers and causing conveyor damage or jamming. The ERT150 is suited to operate in cleanroom environments requiring a pallet handling conveyor. It is capable of zoning for no or low-back pressure accumulation and is ideal for automation assembly applications within industries including medical devices, electronics, consumer goods among others.