IDC predicts a compound annual growth rate of 17% to reach a global total market for robotics around $135 billion by 2019.

The IDC FutureScape Report: Worldwide Robotics 2017 Predictions

John Santagate | IDC Manufacturing Insights

Please tell us a bit about the IDC FutureScape report?

Each year IDC produces a set of predictions around the major markets that we cover throughout the year in our research. We have a specific program that covers robotics where we research and report on the trends and technology in the space. With the FutureScape predictions document, we try to look at where we see some logical change in the market over the coming 3 years and make a set of 10 predictions, which we cover in our research throughout the year.

In the report, IDC predicts a compound annual growth rate of 17% to reach a global total market for robotics around $135 billion by 2019. What is included in this figure? What factors does IDC see as fueling this growth?

For the market forecasts, we take a holistic view of the market based on what we believe to be a comprehensive set of market factors. For robotics, we look at 6 areas: robotic systems (the robots themselves), aftermarket robotics hardware, services related to robotics, system hardware, and software. The market for robotics has been growing considerably over each of the past several years. We are seeing significant investment from VC and private equity into the robotics market as well as top non-traditional robotics companies working on both robots and robotic software. Fueling the growth is a combination of technology improvements and market awareness and acceptance. Across the globe, we are seeing a new industrial revolution with things like Industrie 4.0, Smart Manufacturing Initiatives, China Made 2025, all of which are built around the notion of improving the manufacturing process through digital and automation technology. We are also seeing an uptick in commercial services robotics, applications outside of traditional manufacturing environments where robotics is growing. There are companies like Aethon manufacturing the Tug robot for hospitals, Locus robotics with their ecommerce fulfillment center robots, Rethink Robotics with Baxter and Sawyer for light assembly, and many other emerging vendors in the space. There is also the consumer segment for robotics that is slowing increasing in scale with new robots being developed for a variety of consumer driven purposes. Overall, It is a very exciting market that is advancing quite rapidly as the technology is really starting to catch up to the hype.

Can you talk a little bit about this notion of robot as a service. How does IDC envision the emergence and growth of robot as a service? What are the key elements that you see driving the robot as a service business model?

The idea here is around the availability of robots, primarily in the commercial services segment, that are offered on-demand. Throughout the past year, I have had the opportunity to speak with many robotics vendors who are offering their robots for a fee and available on demand. I have seen this model in use in warehouse and fulfillment center robotics with companies like Fetch and Locus making their robots available on-demand to augment staff in times of peak demand. There is Knightscope which offers their K5 security robot for a hourly fee. More and more we are seeing “as-a-service” emerge across a variety of segments, and robotics is no different. One great use case here is in ecommerce fulfillment centers that experience extreme seasonal spikes in demand. During these times, these centers often bring on a large amount of expensive temporary labor and have to deal with onboarding, training, and often times unpredictability. An alternative option would be to leverage a robotics company within the ongoing fulfillment process, and drop robots into the mix during times of peak seasonal demand in order to reduce the reliance on temporary labor. Much like Software-as-a-Service, Data-as-a-Service, or Platform-as-a-Service, Robot-as-a-Service provides the benefits of deploying robots into a business with flexibility, scalability, and cost savings.

In the report, IDC talks about a growing role for the chief robotics officer and a defined robotics business unit, what does IDC see as the core role of such an officer and/or function? What industries do you believe that such an officer and/or function would be most likely to be in the 30% of leading organizations that take up such a role?

As we think about the growth in robotics technology, it only makes sense that as they become more important to the operations of a business that there be some governing body responsible for managing robotics initiatives. Such a role will likely take on a different set of objectives depending on the role of robots within an organization. It is logical for companies focusing on the development of robots to have this role, as many already do. What’s interesting though, is that as robotics takes on a greater importance across a broader set of industries, that it will become important that an organization develop leadership to manage the multiple facets of robotics for a large organization. Leadership will be critical in developing the vision and mission but also in managing the strategy around the use of robotics across the broader organization. There are robots today for industrial manufacturing, security, warehouse operations, store operations, even landscaping. So the idea here is that as robots can do more things, large organizations will have to deploy a leadership driven team to help drive and support the use and development of robotics for the organization.

You have a prediction around a “mesh of shared intelligence”, can you tell me a little bit about what you mean by this? What led IDC to predict a 200% increase in robotic operational efficiency improvements by 2020 related to this mesh of shared intelligence?

The idea around a “mesh of shared intelligence” is tightly tied to the internet of things. Most robots today are connected in some manner to either a central management system or even to each other through sensors and networking. The idea around the shared intelligence mesh is that these devices, coupled with advancements in cognitive computing and AI, will become efficient at sharing information with each other, to an organization, and we believe that this communication will even extend beyond an internal organization to start to share data across a trade network. The power of the IoT is in the capability to capture, share, and act on all of the data that is constantly being generated. The prediction around the increase in efficiency is largely driven by the notion that as robots efficiently communicate with each other and the external environment, that they will be capable of delivering insight to a business about operations that is occurring in real time.

Did you touch on the social implications of the growth of robotics in the workplace, job losses etc.?

This is obviously one of the most touchy subjects relative to robotics. There are really two schools of thought here, one is that robots will be job takers, while the other is that robotics will be a job maker. We did actually have two predictions around this subject. One is regarding the talent race in the field of robotics and the other was around the potential for government intervention in this space. So the first prediction was that “by 2020, robotics growth will accelerate the talent race, leaving 35% of robotics related jobs vacant while the average salary increases by at least 60%”. We believe that over the coming years, the talent gap around robotics skills will continue to widen. This point really speaks to the potential for robotics to be a job maker in that a new set of skills will be required across a broad range of robotics related areas such as engineering, implementation, operation, systems design, etc. As with any emerging technology, new jobs and new skills required to fill those jobs emerge as that technology becomes more widely adopted. The skills required to build, develop, deploy, manage, and service robots will continue to evolve and as demand for robots in the workplace grows, demand for people with these skills will grow. The other prediction in this area is that “by 2019, governments will begin implementing robotics-specific regulations to preserve jobs and to address concerns of security, safety, and privacy”. This is probably one of the more provocative predictions this years set of predictions. However, job losses impact both those whose jobs have been displaced but also the revenue streams of the government. Less people working results in less income tax collection. So, we believe that governments, and likely trade organizations, will begin to work with corporations to incentivize the use of human labor in order to maintain jobs. We purposefully left the prediction somewhat ambiguous, as we believe that the discussions will begin to gain traction by 2019, but that the complex nature of the intersection between governments, business, technology and society will likely make this a very complex challenge to tackle.

How best can a small manufacturing company interpret the results of this study and apply them to growth in the next few years and beyond?

The biggest take away for a small manufacturing company is that things are rapidly changing. Robotics is no longer just a tool for large industrial manufacturing. Robots have long been in place in industries such as automotive manufacturing and electronics manufacturing, but new robots are continuing to emerge that affordable, easy to use, and less of complex than the traditional idea of an industrial robot. Today it is about understanding where in your business the potential to leverage robotics exists. This may be in the manufacturing process, in warehousing and distribution, for janitorial services, or in security. The biggest take away is that we are moving past the idea of robotics as science fiction, they are rapidly emerging across a wide range of applications to help small businesses augment staff, increase their level of automation, and drive efficiencies.

About John Santagate

As a research manager, John Santagate is responsible for providing research, analysis and guidance on key business and IT issues for manufacturers with a hyper focus on Supply Chain Execution. John holds more than a decade of experience, including advising leading oil, medical device and automobile companies on critical supply chain processes.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

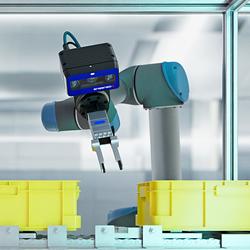

Featured Product