Hardware businesses are notoriously challenging in the vast, dynamic world of startups. There are over 72,500 startups in the U.S. alone, yet only half have a survival rate beyond five years. In hardware startups, the stats are even worse.

Why Do Hardware Startups Fail?

Why Do Hardware Startups Fail?

Gilberto Garcia-Vazquez & Muirae Kenney | MacroFab

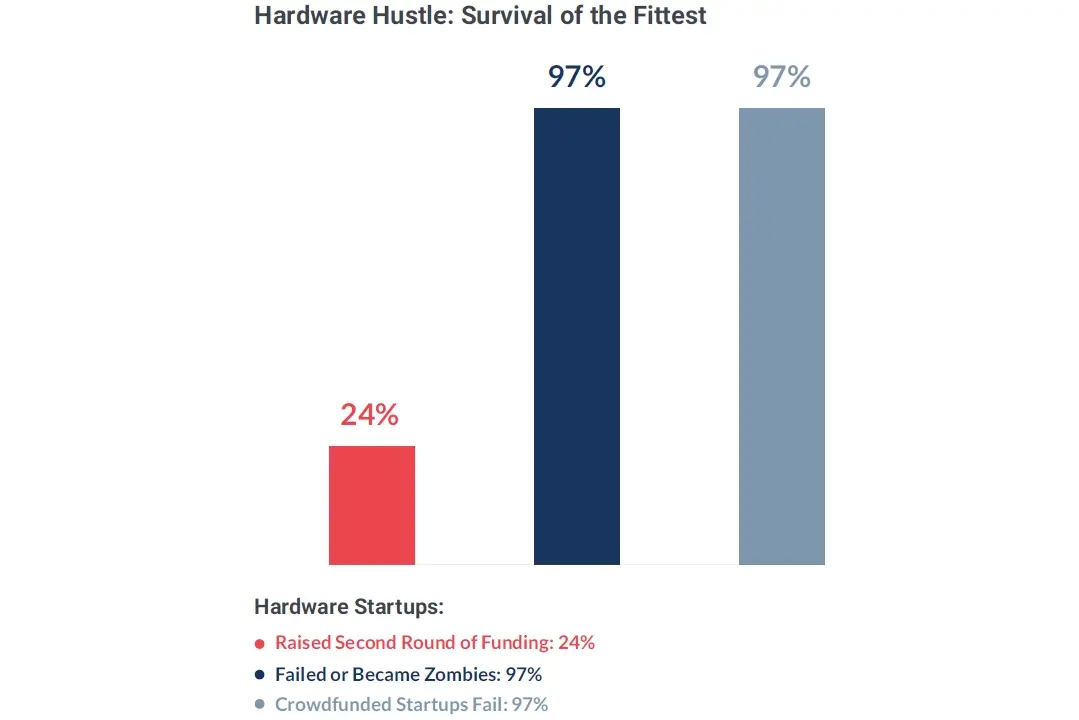

Hardware businesses are notoriously challenging in the vast, dynamic world of startups. There are over 72,500 startups in the U.S. alone, yet only half have a survival rate beyond five years. In hardware startups, the stats are even worse: only 24 percent raise second-round funding, and 97 percent die or become zombie companies.

This stark reality becomes even more pronounced for hardware startups as they face high risks and navigate a path to success littered with obstacles. Yet, despite these odds, entrepreneurs and investors continue to chase the dream of creating the next billion-dollar tech success, constantly fueling the sector’s growth.

But why do so many hardware startups fail? This article explores key factors contributing to the failure of numerous hardware startups, supported by data analysis.

A Brutal Landscape

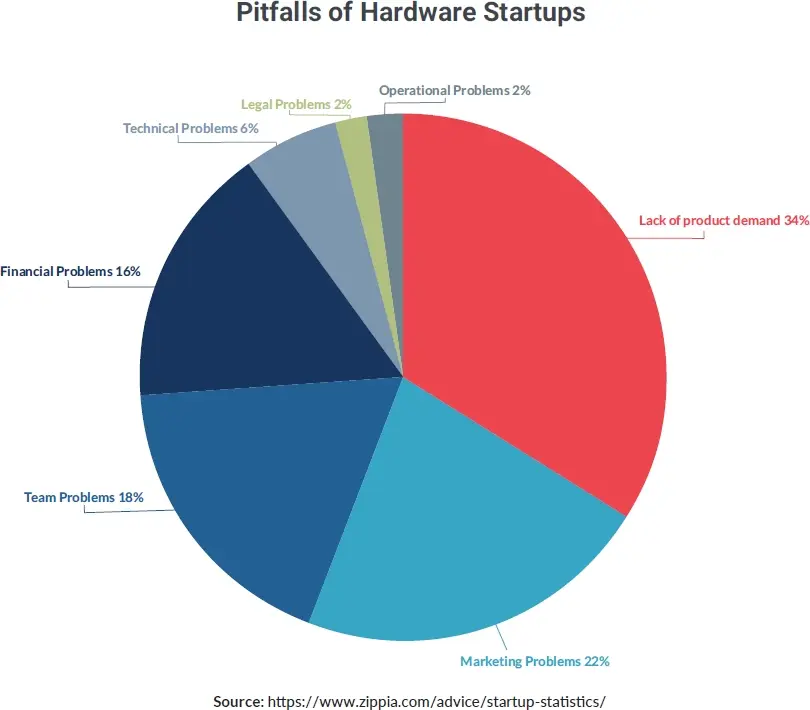

Moreover, recent data suggest that lengthy development times and poor product-market fit contribute significantly to their failure, with 42 percent of startups succumbing to protracted development phases and 34 percent failing due to a lack of product-market fit.

The journey from concept to tangible product in the hardware space encompasses numerous stages that include design, prototyping, testing, manufacturing, and distribution. Each stage takes time, which is a crucial factor that startups must manage efficiently.

The process is particularly challenging when each stage occurs with a different vendor, and there is an extended period of onboarding and downtime between each stage. Prolonged development phases can strain a startup’s limited resources, raising the risk of changing market dynamics or new competitors surfacing while the product is still under development.

Insufficient product-market fit is another key reason behind a third of startup failures. This term refers to the extent to which a product meets strong market demand. As hardware startups strive for innovation, they may create products that, despite being technologically advanced, fail to align with end-user needs or wants. Sometimes, they overestimate their target market size or need to understand the subtle nuances of market behavior. This disconnect between the product and its target market can result in weak sales, low customer retention, and, ultimately, the startup’s downfall.

Hardware development comes with its inherent challenges, such as the need for considerable upfront investment, long development cycles, and robust manufacturing and distribution processes. Further, hardware startups face the uphill task of designing a product that will break through in markets often dominated by established brands.

The Funding Conundrum

Funding plays a crucial role in a startup’s success or failure. But according to Holly Eve at Forbes, less than one percent of startups succeed in securing venture capital, a form of financing that significantly influences their success. Even when startups secure venture capital, the likelihood of becoming a unicorn–or a company valued over $1 billion– is minimal.

In hardware startups, crowdfunding platforms like Kickstarter and IndieGoGo have emerged as vital tools. They enable entrepreneurs to raise capital for concept designs or early-stage prototypes that might not meet traditional venture capital criteria. Still, the common notion among entrepreneurs that crowdfunding exposure will facilitate securing venture capital often doesn’t match reality, as such transitions are still rare.

While crowdfunding can serve as an initial stepping stone for hardware startups by providing both initial funds and visibility, the journey to securing venture capital tends to be more intricate than many entrepreneurs expect. The acquisition of venture capital hinges on several critical factors. Primarily, the product-market fit of the startup’s offering is a fundamental determinant. The product should not only be innovative but also meet substantial market demand, a hurdle that is often a challenging feat for hardware startups.

Moreover, crowdfunding can act as a double-edged sword. The early exposure it provides can set high expectations among the public and potential investors. Failure to meet these expectations can erode trust and act as an obstacle to future funding efforts. Furthermore, the high failure rate of crowdfunded projects can fuel skepticism among prospective venture capital investors. This skepticism presents an additional hurdle for startups in their quest to secure venture capital funding.

Gleaning Insights from Failures

While failure can be a bitter pill, it often catalyzes future triumphs. It’s worth noting that the founders of unsuccessful startups are 20 percent more likely to prosper in their second venture, underlining the value of reflecting on and learning from previous missteps. Moreover, according to a study by the Harvard Business Review, successful entrepreneurs have an average age of 45, suggesting that experience plays a crucial role in startup success. This statistic further bolsters the argument that resilience, informed by past failures, is critical to a successful enterprise.

The ability to weather and learn from setbacks is critical to entrepreneurship. Research from the Kauffman Foundation indicates that the average cost of starting a business from scratch is around $30,000. This underscores the

significance of financial backing for a startup to iterate, pivot, and learn from failures. Thus, wealth and capital contribute to a startup’s survival and enable the learning process that can lead to long-term success.

Conclusion

However, these failures are also rich in insights that can serve as guiding posts for entrepreneurs and investors alike.

Despite the challenges, the spirit of entrepreneurship continues to thrive in the hardware sector. Armed with lessons from past failures, founders continually enter the arena, ready to take another shot at success. The resilience and determination to persevere, learn, and bounce back from defeat are fundamental to this process. Additionally, securing sufficient financial backing allows startups the space to make mistakes, learn from them, and emerge stronger.

In essence, the narrative of hardware startups is one of relentless pursuit of innovation. It is a testament to the entrepreneurial spirit that continues to push boundaries, challenge norms, and aspire to create products that can make a difference.

While the journey may be fraught with failure, each setback lays the groundwork for future successes and contributes to the constant evolution of the sector. As such, the story of hardware startups is as much about failures as it is about wins, as both are intrinsic to the entrepreneurial journey.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Featured Product