Bundy Group is an investment banking and Mergers & Acquisitions advisory specialist that has specialized in the automation and industrial technology markets for over 16 years.

Automation Solutions Mergers & Acquisitions Update

Clint Bundy | Bundy Group

With wind at its back from 2024, the mergers and acquisitions (M&A) market was positioned for a strong 2025 at the start of the year. Despite the broader economy and geopolitical environment introducing potential headwinds and uncertainty, the first three quarters of 2025 did not disappoint from an M&A activity standpoint. Furthermore, the broader automation solutions segment and the robotics subsegment also remained highly active in terms of M&A and capital placement activity.

To provide insights on this dynamic landscape, this update begins with an updated assessment of the overall market—offering essential context for emerging trends in the robotics sector. It also includes an update on M&A activity across both the robotics and broader automation solutions markets.

North American M&A Market

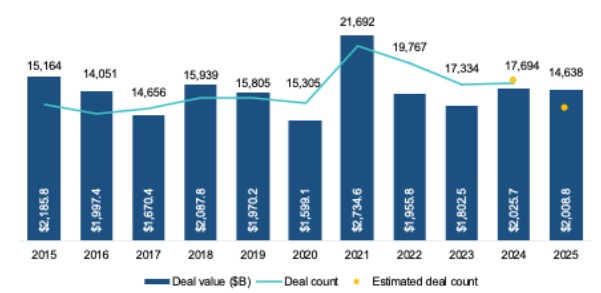

Business owners evaluating a potential sale or acquisition should be aware of how the current M&A cycle has evolved. Following an unprecedented surge in 2021—when North American deal volume reached $2.7 trillion—activity softened through 2022 and 2023. Higher interest rates, a more selective buyer universe, and a general pullback in market confidence pushed total value down to roughly $1.8 trillion by 2023, according to PitchBook.

Market conditions shifted again in 2024. Buyers gradually adapted to the higher-rate environment, capital deployment picked up, and transaction momentum returned. As a result, total deal value increased approximately 16% year over year, reaching $2.0 trillion.

North American M&A Market: By The Numbers

Source: PitchBook

Note: 2025 results as of Sept 30, 2025

For the third quarter of 2025, North American mergers and acquisitions (M&A) activity reached a total transaction value of $762.2 billion across 5,066 announced or completed deals, according to PitchBook. Total deal value achieved a new quarterly record, surpassing the previous high achieved in Q4 2021, and the quarterly deal count was the highest generated since Q1 2022.

This strong performance through Q3 2025 was supported by several notable drivers:

- A meaningful rise in larger-scale transactions: Corporate-level deals and megadeals accounted for a significant share of total value, underscoring renewed confidence among both strategic and financial acquirers.

- Sustained momentum across core B2B segments: Activity within the broader business-to-business landscape-and its related subsegments-continued to outperform, reflecting steady demand for mission-critical products, services, and solutions.

- Improved buyer confidence fueled by shifting economic conditions: Recent interest-rate cuts and greater clarity around near-term economic risks helped ease earlier uncertainty, allowing dealmakers to re-engage pipelines with increased conviction.

- Significant capital availability among both sponsors and strategics: Financial sponsors remain well capitalized, and corporate buyers continue to carry strong balance sheets. This combination has created elevated competition for high-quality, growth-oriented businesses across multiple sectors.

Through the end of the third quarter, the region remained on track to approach $2.7 trillion in total transaction value for 2025, extending a three-year growth trajectory, per PitchBook data.

At Bundy Group, we are seeing this momentum reflected across the B2B and tech-enabled services sectors—both of which encompass automation and robotics solutions. Deal activity remains healthy, though experienced acquirers are showing heightened selectivity. While they may not say so outright, buyers are scrutinizing how economic conditions affect revenue visibility, backlog stability, and long-term performance. Their goal is unchanged: to pursue strong companies while securing pricing and terms that favor the buyer’s risk profile.

The Robotics M&A Market

As a dedicated M&A advisor to the automation market for over 16 years, Bundy Group has consistently observed strong momentum in the M&A and capital markets for robotics solutions companies. This growth is fueled by several key forces: the sector’s rapid expansion, the acceleration of AI-enabled robotics capabilities, rising automation demand amid persistent labor shortages, and the compelling return profiles that robotics-focused financial sponsors are targeting.

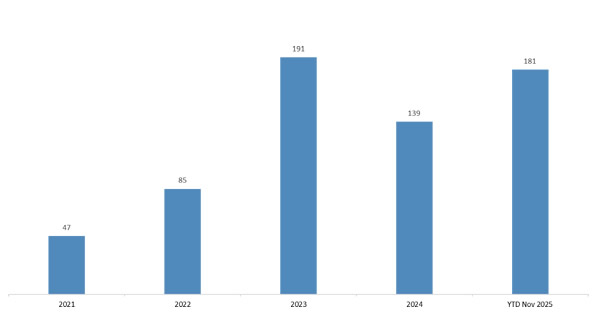

As illustrated in the charts below, both the robotics and broader automation solutions markets remain highly active—clear evidence of sustained investor and strategic buyer engagement. Bundy Group’s own transaction activity reflects this strength, including the successful sales of three automation solutions companies over the past eight months. Our active mandates and expanding robotics pipeline point to the same conclusion: robotics and automation M&A continue to show substantial runway and strong buyer and investor appetite, with no signs of slowing as we move into 2026.

Total # of Automation M&A Transactions

Representative Robotics Transactions (2025)

Mimic

Stage: Seed / Early Stage

Description: Zurich-based robotics firm developing AI-driven manipulation and dexterous automation systems for industrial use.

Sereact

Stage: Series A

Description: Developer of AI-powered robotic picking and perception systems used in warehouse and manufacturing automation.

Ati Motors

Stage: Series B

Description: Autonomous mobile robotics company providing AI-enabled AMRs (Sherpa platform) for industrial and logistics environments.

Gecko Robotics

Stage: Series D

Description: Industrial inspection robotics company deploying wall-climbing robots and AI analytics for critical infrastructure.

Daedalus Industrial

Stage: Private Equity Investment

Description: Industrial automation and robotics engineering firm serving complex manufacturing, energy infrastructure, and data center markets; invested in by LongueVue Capital.

ROBO MAT

Stage: Strategic Acquisition

Description: Swiss builder of special-purpose machinery and robotic production systems; acquired by VINCI Energies.

Takeaways on the Robotics M&A Market:

Robotics Activity Spanning End-Markets

Robotics transaction activity in 2025 reflects the technology’s deepening role across a wide range of industrial and critical infrastructure markets. Acquisitions and investments touched nearly every major automation-driven sector—including agriculture, logistics, energy and alternative energy, data centers, industrial manufacturing, and food & beverage. These industries continue to face structural labor constraints and rising automation demands, positioning robotics solutions as essential, not optional.

AI + Robotics: The Dominant Technology Stack

A defining characteristic of 2025 transactions is the tight integration of artificial intelligence with robotics hardware. A plethora of deals featured AI-enabled perception, manipulation, autonomy, or planning systems—now a common “1–2 punch” in the robotics segment.

This pairing is accelerating:

- AI for robot decision-making and adaptability

- Robotics hardware for real-world execution and workflow automation

- Deals in humanoids, mobile platforms, advanced inspection robotics, and collaborative systems all highlight this convergence.

Robotics Solutions Addressing Real Industrial Constraints

Across the 2025 deal universe, robotics companies provided solutions tied directly to high-value operational problems, including:

- Infrastructure and industrial inspections

- Last-mile or on-site material transport

- Packing, palletizing, and end-of-line automation

- Camera and vision-driven quality and measurement workflows

- Physical labor augmentation (manufacturing, warehouse, energy, agriculture, field operations)

Capital Continues to Flow Across All Stages

Funding remained a major driver of robotics activity in 2025. Investment ranged from:

- Seed and early-stage companies

- Growth rounds (Series A–C)

- Late-stage rounds (Series D)

- Private Equity and Change-of-Control Transactions

- Strategic acquisitions

The level of capital deployed, and acquisitions completed, demonstrates continuing institutional belief that robotics adoption is at the early stages of a long multi-decade expansion.

Clint Bundy is Managing Director with Bundy Group, a boutique investment bank that specializes in representing automation, robotics, industrial technology, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 36 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions.

The content & opinions in this article are the author’s and do not necessarily represent the views of RoboticsTomorrow

Featured Product