Robotics, artificial intelligence fund has tripled the Dow this year

Evelyn Cheng for CNBC: Artificial intelligence, machine learning and robotics are making some real money for stock investors, and beating the market.

Evelyn Cheng for CNBC: Artificial intelligence, machine learning and robotics are making some real money for stock investors, and beating the market.

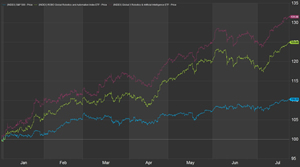

The Global X Robotics and Artificial Intelligence ETF (BOTZ) is up 30 percent this year and the ROBO Global Robotics and Automation Index (ROBO) is up 25 percent. That's roughly three times the Dow Jones industrial average's 9 percent rise and twice the S&P 500's 11 percent climb.

"Between the tech exposure and the international exposure, that's helped the group pretty well," said Jack Ablin, chief investment officer at BMO Private Bank. "Certainly thematically it's in a sweet spot."

The upward trend in robotics and artificial intelligence stocks is one proponents say, in the long-term, could top the so-called FANG stocks — Facebook, Amazon.com, Netflix and Google parent Alphabet. Each FANG stock has rallied 20 to 50 percent this year and the companies are increasingly focused on using technologies such as artificial intelligence, or AI, to develop their businesses.

"In our opinion, robotics, automation, AI — [RAAI] is really the next FANG trade if you will," William Studebaker, president and CIO at Robo Global, told CNBC. Full Article:

Featured Product